Ryan Bradley | October 31, 2025 | Car Accident \ Missouri Law

Key Takeaways:

- A letter of representation stops insurers from contacting you. Once your attorney sends this letter, all communication goes through them. Adjusters shouldn’t contact you anymore or request recorded statements.

- It’s not the same as a demand letter. The letter simply notifies insurers that you have legal counsel. The demand letter comes later and outlines your damages and the requested settlement amount.

- You need this letter as soon as you hire an attorney. The sooner your lawyer sends a letter of representation, the sooner you’re protected from saying something that could hurt your claim.

Three calls in one week, and you don’t know what to say anymore. Only last week, you were injured in a car accident in St. Louis, and the insurance adjuster just keeps calling. They’re asking for a recorded statement and have made a settlement offer. But you’re not sure if the offer covers all your losses, and every conversation with the adjuster feels like they’re trying to trip you up.

This is when you need an experienced Missouri personal injury lawyer in your corner. Once they send the letter of representation, all of that stops. You are now protected from saying anything that an insurer could use against you.

What Is a Letter of Representation?

A letter of representation is a formal legal document that your attorney sends to insurance companies notifying them that you’ve hired legal counsel. It’s legally binding and determines that all future communication about your claim must go through your attorney.

Once the insurance company receives this letter, they or their attorneys can no longer contact you directly. They can’t call you or show up at your door asking questions. Any attempt to communicate with you after receiving this letter violates professional standards and legal ethics rules. Under Missouri Supreme Court Rule 4-4.2, attorneys and their agents cannot communicate directly with a represented party without their lawyer’s consent.

At Bradley Law, we want to protect you from insurers’ tactics immediately, and typically send your letter of representation to insurance companies within 24-48 hours.

What Does a Letter of Representation Do?

A letter of representation for a personal injury changes how your claim is handled. Here’s what it does:

- No More Direct Contact from Adjusters. You won’t have to worry about calls or surprise visits anymore. Insurance adjusters must now deal with your lawyer, and only your lawyer.

- Protects You from Saying the Wrong Thing. Every word you say to an adjuster can be twisted and used against you. The representation letter eliminates that risk.

- Faster Coordination of Medical Records. Your attorney can now obtain your medical records directly, streamlining the claims process.

- Preserves Evidence and Starts Building Your Case. The attorney’s letter to the insurer triggers the start of legal proceedings. Your attorney will now gather evidence, such as police reports and accident scene photos.

- Clear Case Updates. Instead of juggling calls and letters from insurance companies, medical providers, and other parties, you get straightforward updates from your attorney.

What’s Included in a Letter of Representation

A properly drafted representation letter contains specific information that makes it legally effective, including:

- The claimant’s full name and contact information

- The date and location of the accident

- The insurance claim number (if available)

- A statement explaining that you’ve retained legal counsel and won’t communicate directly with insurers

- Your attorney’s contact information

- The request for all claim documents to be sent to your lawyer

- A preservation of evidence notice

With a professionally crafted letter or representation in place, your attorney takes control of the legal process and starts building a strong case for you.

Letter of Representation vs. Demand Letter

The two legal documents serve completely different purposes. A letter of representation comes long before a demand letter. Your attorney will send a letter or representation almost immediately after you agree to work with them. It’s a simple notice to the parties in your claim to stop contacting you directly. It doesn’t make any claims or outline damages.

On the other hand, a demand letter comes later, which can be weeks or even months after the letter of representation. A demand letter is the first step in filing a lawsuit and describes what happened, your injuries, and the damages you request, such as medical bills, lost wages, and pain and suffering.

Think of the representation letter as your attorney’s first move. It simply protects you, while the demand letter starts settlement negotiations in earnest.

Speak With An Attorney About Your Case

When Do You Need a Letter of Representation?

You’ll need a letter of representation as soon as you hire a personal injury attorney. Every day that passes without the attorney’s letter to the insurer is another day that adjusters can contact you directly, fishing for information they can use to deny or reduce the claim.

After any car accident or personal injury in Missouri, whether a crash on I-70, a slip and fall at a business in Kansas City, a workplace injury, or a truck collision, adjusters will start calling. Once the letter is sent, you can focus on your recovery instead of having to deal with adjusters who want you to say something that compromises your claim.

At Bradley Law, we’ve seen too many people try handling claims alone for months. They’ll say the wrong thing to an adjuster and come to us with a much harder fight. Don’t make that mistake. Protect yourself and your claim immediately.

Common Myths About Letters of Representation, Answered

Myth: Hiring a lawyer and sending a letter of representation will make the insurance company angry and ruin my chances of getting what I deserve.

Truth: Insurance companies deal with represented claimants every day. They’re not going to deny a valid claim just because you hired an attorney; quite the opposite. Insurers take claims more seriously when they know an experienced lawyer is involved.

Myth: I can handle my claim alone and save money by not hiring a lawyer.

Truth: This may work in a minor claim, where an insurance company agrees to settle for a fair amount. However, if you have significant injuries and financial damages, be prepared for a fight to get what you deserve. You’ll likely be up against powerful national insurers and their lawyers. Insurance adjusters know you don’t understand the law, the claims process, or what your case is worth. And you’ll end up leaving money on the table.

Myth: Once I send a letter of representation, I’m locked into that attorney forever.

Truth: You can fire your attorney and hire a different one at any time. A representation letter isn’t a permanent contract. If you’re unhappy with your lawyer, you have the right to switch firms.

Step-by-Step: Bradley Law’s Process

Here’s what happens when you hire Bradley Law to handle your personal injury case:

- Step 1: Free Consultation. You contact us and explain what happened. Bradley Law evaluates your case at no cost, and we’ll tell you honestly whether you have a strong claim and how we can help.

- Step 2: You Sign the Representation Agreement. If you decide to hire us, the next step is signing a contingency fee agreement. This means you agree to work with us and don’t pay anything upfront. We only get paid if we win your case.

- Step 3: We Send the Letter of Representation. Shortly after signing with us, we draft and send your letter of representation to every insurance company and party involved in your case. This stops them from directly contacting you.

- Step 4: We Start Building Your Case. We’ll start building your case and collect evidence, such as police reports, medical records, and witness statements. We’ll also review insurance policies and calculate the full value of your damages.

- Step 5: Our Team Handles All Communication. Insurance adjusters now deal with us, and you’ll be in good hands. Our founder, E. Ryan Bradley, used to defend insurance companies before switching sides to fight for injury victims. We’ll protect you from lowball offers and bad-faith denials.

- Step 6: We Keep You Updated. You’ll get regular updates on your case status and settlement offers. Bradley Law won’t keep you in the dark about your claim.

- Step 7: Our Attorneys Negotiate or Litigate. Many cases settle through negotiation, but if the insurance company refuses to offer fair compensation, we’re prepared to file a lawsuit. Insurance companies know Bradley Law doesn’t shy away from trial and fights for what is just and fair.

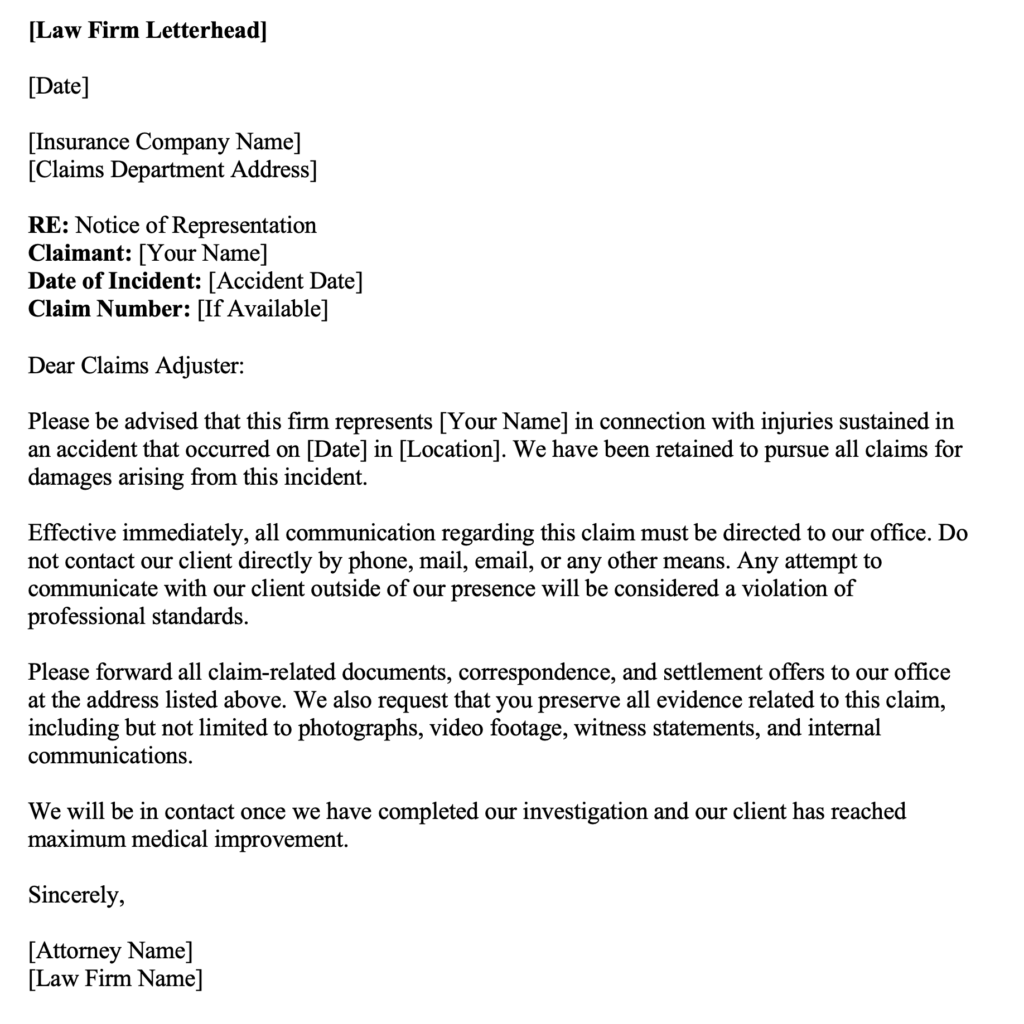

Sample Letter of Representation (For Reference Only)

Here’s what a letter of representation typically looks like:

This is a simplified example. Your attorney’s letter may include additional language depending on your specific case and Missouri law requirements.

What to Do Before and After the Letter

Before your attorney sends the letter of representation to an insurance company, protect yourself: Politely decline recorded statements and say you’ll get legal advice first. Missouri is a comparative fault state under § 537.765 RSMo, meaning anything you say admitting fault can be used to reduce your compensation.

Don’t sign any documents, including medical releases or settlement agreements. And it’s crucial that you don’t discuss fault or apologize, as even innocent statements can be used against you.

After your attorney sends the letter, don’t engage in any insurance calls and refer adjusters to your legal counsel. If they keep contacting you, tell your lawyer. Follow your doctor’s treatment plan and attend all medical appointments. Retain all receipts for all accident-related expenses. And make sure you stay in touch with your lawyer and respond to their calls promptly.

FAQs

Can I still talk to my own insurance company after a letter of representation is sent?

Yes, but be careful what you say. Your own insurer may contact you about policy renewals or payments, which is fine. But as soon as they’re asking about the accident or your injuries, refer them to your attorney to be safe.

What happens if the insurance company ignores the letter of representation and contacts me anyway?

Tell your attorney. Contacting a represented party violates legal ethics rules and can result in sanctions against the insurance company. Your lawyer may file a complaint with the Missouri Bar or even use the violation as leverage in settlement negotiations.

How long does it take for the insurance company to respond after receiving a letter of representation?

There’s no legal deadline for insurers to respond to a letter of representation in Missouri. Some acknowledge it within days, while others may take weeks. What matters is that they stop contacting you directly.

Why Choose Bradley Law?

There are many personal injury attorneys and law firms in Missouri, but they’re not all the same. Here’s why Bradley Law is different:

- We Know How Insurance Companies Think. Our founder, E. Ryan Bradley, spent years defending insurance companies. We know their playbook, delay tactics, and pressure strategies. That insider knowledge gives our clients an advantage.

- We’ve Recovered Over $100 Million. We’ve won record-breaking settlements and verdicts in Missouri. Insurance companies know we’re serious about taking cases to trial if they won’t offer fair compensation.

- We Work on Contingency. You don’t pay any attorney’s fees or legal expenses upfront. We only get paid if we win your case, so there’s no financial risk for you when hiring us.

- We’re Available 24/7. Accidents and injuries don’t just happen during office hours. When you need help, we’re here for you. Call us anytime, and we’ll start protecting your rights.

Get Help Today

Injured in a car accident, truck crash, slip and fall, or any other incident caused by someone else’s negligence in Missouri? Don’t wait to get legal help. The sooner we send a letter of representation, the sooner you are protected and can concentrate on your recovery.

Every day you delay is another opportunity for insurance companies to try and sink your claim. At Bradley Law Personal Injury Lawyers, we send your letter of representation immediately after you hire us, protecting you from an adjuster’s manipulative tactics while we build the strongest possible case for maximum compensation.

Contact us now for a free consultation and let us start fighting for you.